Aussie House Purchase Costs Calculator Guide

Our house purchase costs calculator guide breaks down every hidden fee. Budget for stamp duty, LMI, and legal costs in Australia with confidence.

Getting your head around all the costs of buying a house is probably the most crucial first step you'll take. A good house purchase costs calculator takes you way beyond the big, shiny sale price and shows you the real amount of cash you'll need upfront. We're not just talking about the deposit; there are a bunch of other expenses like stamp duty, legal fees, and insurance that can easily add another 5-10% to your total budget.

The True Cost of Buying a Home in Australia

That price you see on the property listing? Think of it as the starting line, not the finish. So many first-time buyers get laser-focused on hitting that deposit goal, only to be caught off guard by the hefty stack of extra bills needed to actually get the keys in their hand.

This is exactly where a house purchase costs calculator becomes your best friend. It gives you a clear, itemised breakdown of every single dollar you'll need to have ready on settlement day. It’s like a financial roadmap, making sure you don't take a wrong turn into a dead-end of unexpected fees.

Beyond the Deposit: What You Really Need to Budget For

Let's say you've found a place you love in Melbourne for around the median price. That number is just one piece of the puzzle. You've got to factor in several other major expenses that can quickly run into the tens of thousands.

Here are the big ones you absolutely can't forget:

- Stamp Duty (or Transfer Duty): This is a state government tax on the property purchase. Honestly, it's often the biggest single cost you'll face after the deposit.

- Conveyancing or Legal Fees: You need a solicitor or conveyancer to handle all the legal paperwork. Budget for somewhere between $1,500 and $3,000 for their expertise.

- Lenders Mortgage Insurance (LMI): If your deposit is under 20% of the property’s value, your bank will almost certainly make you pay LMI. It’s a one-off insurance premium, but it protects the lender, not you.

- Building and Pest Inspections: Don't even think about skipping these. They're vital for your peace of mind and will set you back about $500 to $1,000.

To give you a clearer picture, here’s a quick summary of those key upfront costs you'll need to plan for.

Quick Guide to Key Upfront Purchase Costs in Australia

This table breaks down the main one-off expenses you'll encounter when buying a home, completely separate from the property price itself.

| Cost Component | Typical Amount / Range (AU) | Why It's Important |

|---|---|---|

| Stamp Duty | Varies by state/territory and property value (can be 3-5% of the price) | Often the largest upfront cost after the deposit. Essential to budget for. |

| Legal/Conveyancing Fees | $1,500 - $3,000 | Covers the legal transfer of property ownership. A non-negotiable cost. |

| Lenders Mortgage Insurance (LMI) | 1-4% of the loan amount if a <20% deposit | A significant one-off fee required by lenders for low-deposit loans. |

| Building & Pest Inspections | $500 - $1,000 | Identifies potential structural or pest issues before you commit. A small price for peace of mind. |

| Loan Application/Establishment Fees | $0 - $800 | Fees charged by the lender to set up your mortgage. |

Seeing it all laid out like this really drives home how much you need to have saved beyond your deposit.

The Financial Pressure for First Home Buyers

Today's market really highlights why this kind of detailed budgeting is so important. It's tough out there for first-home buyers, and affordability is a massive hurdle. In fact, recent data shows only 16% of suburbs are considered affordable for the average person seeking a mortgage.

What’s more, a huge 70% of first home buyers are getting into the market with less than a 20% deposit. These numbers, pulled from the Finder First Home Buyer Report 2025, show just how tight things are financially, making an accurate cost calculation more critical than ever.

Knowing all these variables is the secret to a smart, financially sound property purchase. A detailed calculation means no last-minute panic, and it ensures you have enough cash to cover everything without raiding your emergency fund.

At the end of the day, getting a handle on these upfront costs is just as important as understanding Australian mortgage rates and how they’ll impact your repayments down the track. It's all about building a complete and honest picture of your financial commitment from day one.

Getting the Right Numbers for a Spot-On Result

There’s an old saying in the tech world: "rubbish in, rubbish out." It's never been more true than when you’re plugging numbers into a house purchase costs calculator. The final estimate is only as good as the figures you feed it.

Think of it like a pre-flight checklist for your property journey. Getting these numbers right from the start means the result will be one you can actually bank on, without nasty surprises down the track. Just guessing at the inputs can throw your entire budget out by thousands.

Your Deposit and Buyer Type

First things first, you need your exact deposit amount. This is the cornerstone of the whole calculation. It sets your loan-to-value ratio (LVR) and, maybe most importantly, determines if you’ll get stung with Lenders Mortgage Insurance (LMI).

Next, you need to be clear about what kind of buyer you are. Are you buying your first home? Are you an investor? Or are you an owner-occupier who’s been through this before? Your answer really matters because it unlocks different grants and concessions within the calculator.

- First Home Buyers can often tap into stamp duty exemptions or major discounts, not to mention government grants. These can slash your upfront costs. This first home buyer guide for Australia is a great resource for navigating what’s available.

- Investors, on the other hand, usually face the highest costs. They don't qualify for the perks and are sometimes hit with higher interest rates.

Getting your buyer type right ensures the calculator applies the correct rules for your situation.

Nailing Down the Variable Costs

While your deposit is a hard number, a few other expenses need a bit of detective work. Whatever you do, don't just pull a number from thin air for these.

Legal and Conveyancing Fees This is one of the big ones. Expect to pay anywhere from $1,500 to over $3,000 for a solicitor or conveyancer to handle the paperwork. The final bill depends on how complex the sale is and where you're buying.

A smart move is to ring two or three local conveyancers and ask for a fee estimate for a standard purchase in your price bracket. Take the average and pop that figure into the calculator.

Building and Pest Inspections Don’t even think about skipping these. A combined building and pest report is essential peace of mind. You should budget between $500 and $1,000 for a thorough job, though this can vary with the property's size and location.

A classic mistake is to shrug off these 'smaller' costs. But a few hundred dollars here and a couple of thousand there adds up fast. If you don't account for them properly, you could find yourself with a serious budget shortfall right when you can least afford it.

By spending a little time gathering these real-world figures, you turn a simple calculator into a seriously powerful financial planning tool. The whole point is to eliminate surprises, and that begins with feeding it accurate, well-researched numbers. When you do that, the final figure it gives you is a target you can genuinely work towards.

Where you buy a house in Australia isn't just a lifestyle choice—it's a massive financial one. The exact same property price can lead to wildly different upfront costs simply by crossing a state line. Why? Because each state and territory plays by its own rulebook for property taxes and grants.

A good house purchase costs calculator is built to handle this for you. You just need to select the state, and it automatically applies the correct stamp duty rates, first home buyer concessions, and any other local fees. Trying to guess this on your own could leave your budget out by tens of thousands of dollars.

The Big One: Stamp Duty Variations

Stamp duty, or transfer duty as it's sometimes called, is easily the biggest variable you'll come up against. It’s a hefty state government tax on your purchase, and frankly, it can feel like a kick in the guts. The amount you pay changes dramatically from one state to the next.

For instance, the duty on an $800,000 property in Victoria is a completely different story to what you'd pay in Queensland. These aren't small differences; we're talking about huge sums of cash you need to have ready to go at settlement.

One of the most common traps for buyers is underestimating just how much location blows out the final figure. A lot of people mistakenly assume stamp duty is a standard, nationwide tax. It's a costly mistake. Always use a calculator that's properly localised for Australian states to get the real story.

This is why looking at national property price averages is pretty useless for your personal budget. The Australian residential property market is a beast, with the total value of dwellings recently hitting around AUD 11.37 trillion. But that macro view doesn't help you much on the ground. The mean price in New South Wales is $1,245,900, while in Victoria, it's $899,700. Those price gaps are then magnified by each state's unique tax system. You can dig deeper into these trends over at the Australian Bureau of Statistics.

State-by-State Stamp Duty and First Home Buyer Grant Snapshot

To give you a clearer picture, here’s a quick look at how stamp duty and first home buyer help can vary across the country for an $800,000 property.

| State/Territory | Estimated Stamp Duty on $800k Property | Typical First Home Buyer Grant / Concession |

|---|---|---|

| NSW | ~$30,500 | Full exemption up to $800k, concession up to $1M. |

| VIC | ~$43,000 | Exemption up to $600k, concession up to $750k. |

| QLD | ~$21,500 | Concession up to $550k. $15k grant for new builds. |

| WA | ~$31,500 | Full exemption up to $430k, concession up to $530k. |

| SA | ~$38,000 | No stamp duty concession, but a $15k grant is available. |

| ACT | ~$25,000 | Concessions available based on income thresholds. |

As you can see, the differences are huge. A first home buyer in NSW could save over $30,000 in stamp duty compared to a standard buyer, while someone in Victoria buying the same priced home might not receive any stamp duty relief at all. This table is just a guide—rates and rules change, so always check the latest government information for your state.

How First Home Buyer Grants and Concessions Can Help

Just as states hit you with different taxes, they also offer different lifelines to help first home buyers crack into the market. These grants and stamp duty concessions are absolute game-changers, potentially saving you a fortune and making a purchase possible.

But, you guessed it, the rules and the savings vary wildly everywhere you look:

- New South Wales: Offers a full stamp duty exemption for first home buyers up to a certain price, with discounts available for properties above that.

- Victoria: Runs a similar exemption and concession scheme, but with totally different price caps and eligibility rules.

- Queensland: Has its own unique take on stamp duty concessions, often tied to their First Home Owner Grant for new builds.

A smart house purchase costs calculator automatically factors these in. As soon as you tick the "I'm a first home buyer" box, it should instantly recalculate your total upfront cash needed, showing you the real-world impact of government help on your bottom line.

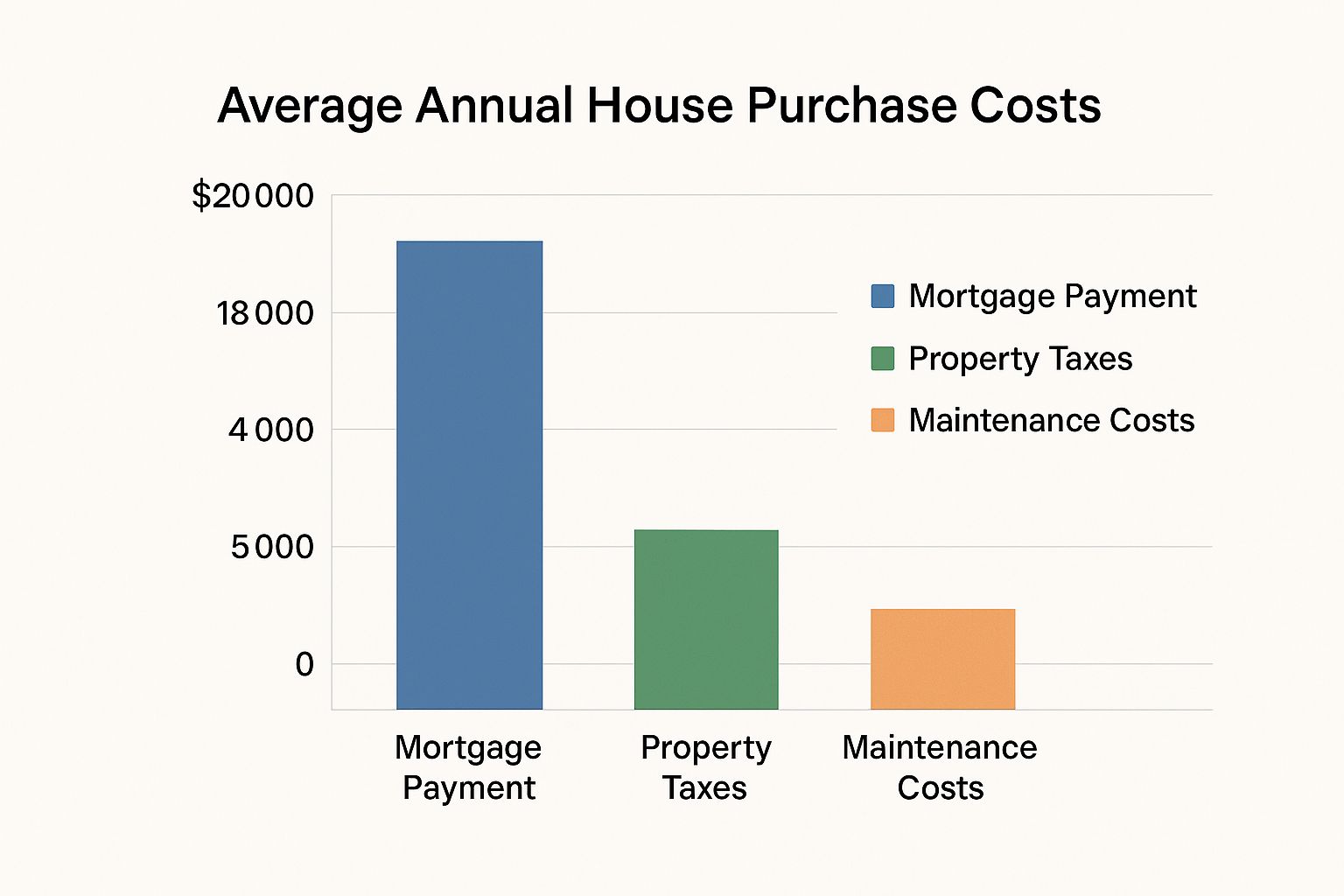

This infographic breaks down some of the major ongoing costs you'll need to budget for well after you've picked up the keys.

It’s a great reminder that while your mortgage repayment is the biggest slice of the pie, ongoing costs like council rates, insurance, and maintenance add up fast and need to be part of your long-term plan.

Planning for the Ongoing Costs of Ownership

Getting the keys to your new home is an incredible moment, but it’s definitely not the financial finish line. A truly solid budget looks past the initial hurdles and accounts for all the recurring expenses that kick in the moment you move in—and stick around for as long as you own the place.

Getting the keys to your new home is an incredible moment, but it’s definitely not the financial finish line. A truly solid budget looks past the initial hurdles and accounts for all the recurring expenses that kick in the moment you move in—and stick around for as long as you own the place.

Thinking beyond the purchase price is what separates a comfortable homeowner from a stressed one. While a house purchase costs calculator is brilliant for adding up all those upfront fees, you also need a clear picture of the ongoing costs that often catch first-home buyers by surprise. Getting ahead of this means you can build a sustainable budget and avoid nasty shocks down the track.

Factoring in Rates and Levies

Your mortgage repayment will almost certainly be your biggest monthly expense, but it's far from the only one. There are several regular, non-negotiable bills that are just part of the deal when you own property in Australia.

You'll need to make room in your budget for:

- Council Rates: These are paid quarterly to your local council to fund services like rubbish collection, local roads, parks, and libraries. Expect to pay anywhere from $1,500 to over $3,000 a year, depending on your property's value and council area.

- Water Rates: This bill covers your water supply and sewerage services. It’s also typically quarterly and is usually made up of a fixed service charge plus what you actually use.

- Strata or Body Corporate Levies: If you’re buying an apartment, townhouse, or unit, these fees are mandatory. They cover the maintenance of common areas, building insurance, and admin costs, and can easily run into thousands of dollars each year.

The Unseen Costs That Catch You Out

Beyond those predictable bills, a few other expenses have a nasty habit of catching new homeowners on the hop. If you haven't planned for them, they can quickly throw a well-meaning budget into chaos.

Home and contents insurance, for instance, is non-negotiable. Your lender will insist on building insurance as a condition of the mortgage, but you'll also want contents cover to protect your personal belongings. Depending on your level of cover and location, this can set you back $1,000 to $2,500 (or more) every year.

The most overlooked ongoing expense is, without a doubt, general maintenance and repairs. A good rule of thumb I always share with clients is to set aside 1% of your property’s value each year for this. For a $700,000 home, that’s $7,000 annually—or about $135 a week—for things like a hot water system that gives up the ghost or a roof that suddenly springs a leak.

Think of it as a "sinking fund" for your home. It’s your financial buffer against the inevitable wear and tear. When you start factoring these ongoing expenses into your long-term plan, you get a much more realistic picture of your total financial commitment, which is the key to enjoying your new home without the constant money worries.

Turning Your Calculator Results Into a Winning Strategy

Alright, you've punched in the numbers and the calculator has done its thing. What you're looking at now is much more than a summary of costs—it's the foundation of your entire purchasing plan. This is the moment you move from just estimating to actually strategising.

Don't make the mistake of just skimming the final total. The real gold is in the details, and understanding them gives you the confidence to make your next move. There are really three key figures that tell the most important parts of your financial story.

Making Sense of the Key Numbers

First up is your total cash needed. This is the big one. It's not just your deposit but the full, lump-sum amount you'll need ready to go on settlement day. Think stamp duty, legal fees, and all those other pesky costs rolled into one. This is essentially your go/no-go number for making an offer.

Next, you'll see your estimated monthly repayments. Take a good, hard look at this. It’s a sneak peek into your future budget. Be honest with yourself—can you genuinely afford this every single month without being stretched to your limit, especially if interest rates nudge up a bit?

Finally, check your loan-to-value ratio (LVR). This little percentage is crucial. If it creeps above 80%, a big red flag should pop up. That's the trigger point for Lenders Mortgage Insurance (LMI), an extra expense that can easily add thousands to your upfront bill.

What If? Playing with Different Scenarios

This is where the calculator really shines. It’s your financial sandbox, a place to play "what if" and see how tweaking a few variables can dramatically change the outcome.

Give these adjustments a try to find your financial sweet spot:

- Bump up your deposit: See what happens if you can scrape together an extra $10,000. Notice how it drops your LVR, which could be your ticket to avoiding LMI altogether and lowering those monthly repayments.

- Tweak the property price: How much difference would a slightly cheaper house make? Knocking just $25,000 off the price can cause a surprisingly big drop in your upfront costs, especially the dreaded stamp duty.

- Extend the loan term: Look at the difference between a 25-year and a 30-year loan. A longer term will almost always mean lower monthly repayments, but it's a trade-off—you'll pay more in total interest over the life of the loan.

This kind of forward-planning is non-negotiable in the current market. With the median Australian dwelling value sitting at $815,912 and owner-occupier interest rates hovering around 6.22%, there's very little wiggle room. Borrowing power isn't what it used to be, which makes mapping out these different possibilities more critical than ever.

When you test different scenarios, you’re not just crunching numbers; you’re building a financial game plan. You might find that saving for a slightly bigger deposit saves you a fortune in the long run by dodging LMI, or that aiming for a lower price bracket makes your budget feel a whole lot more comfortable.

This isn't just for first-timers, either. Seasoned investors rely on this same process to fine-tune their portfolios. For them, modelling scenarios is a core part of developing smart Australian property investment strategies for 2025 and staying ahead of the game.

Common Questions About Home Purchase Costs

<iframe width="100%" style="aspect-ratio: 16 / 9;" src="https://www.youtube.com/embed/gTBloa52E7Y" frameborder="0" allow="autoplay; encrypted-media" allowfullscreen></iframe>Figuring out the money side of buying a home can feel like a maze. Even with a good house purchase costs calculator, you’re bound to have questions. Let's break down some of the most common ones we see from Aussie buyers.

Getting these details sorted helps you lock in your budget and sidestep any nasty surprises. It’s all about moving from a rough guess to a real, workable financial plan.

How Much Cash Do I Actually Need on Top of My Deposit?

This is the big one, and the answer often catches people off guard. A solid rule of thumb is to have an extra 4-6% of the property's purchase price sitting in your bank account.

So, if you’re eyeing a $700,000 home, you'll need another $28,000 to $42,000 in cash. This isn't just a "nice-to-have" buffer; it’s for essential costs like stamp duty, conveyancing fees, and building inspections. Having it ready means you won't be scrambling for funds right before settlement.

Pinpointing this total cash figure is the single most important job of a house purchase costs calculator. It’s not just about the deposit—it’s about the total amount of money you need ready to go to make the purchase happen.

What's the Deal with Lenders Mortgage Insurance (LMI)?

Lenders Mortgage Insurance, or LMI, can be a bit confusing. It's an insurance policy that protects the lender—not you—in case you can't pay back the loan.

You'll usually have to pay LMI if your deposit is less than 20% of the property's value, meaning you're borrowing more than 80%. It’s a hefty one-off cost, but you can often capitalise it, which means adding it to your total loan balance. Just remember, doing that means you’ll be paying interest on the LMI premium for years to come.

Can I Put the First Home Owner Grant Towards My Deposit?

This really depends on where you live. In some states, you might be able to use the grant as part of your deposit, but many lenders will still want to see that you've built up your own genuine savings over time.

It's super important to check the rules with both your state government and your specific lender. The grant is a great leg-up, but don't automatically assume it can form the core of your deposit.

Are the Costs Different for an Investment Property?

Yes, absolutely. The numbers change quite a bit when you're buying an investment.

Investors can't access any first home buyer grants or stamp duty concessions, so their upfront tax bill is often much higher. On top of that, interest rates on investment loans are frequently a bit higher than for owner-occupier loans, which will affect your ongoing costs.

We've covered some of the most common questions buyers have when tallying up their purchase costs. To make things even clearer, here are a few more quick answers.

Frequently Asked Questions

| Question | Answer |

|---|---|

| How accurate are online purchase cost calculators? | They are excellent for estimation and budgeting. A good calculator, like those from CalcWidgets, will use up-to-date state-based data for stamp duty and grants, giving you a very reliable estimate to plan with. |

| What's the single biggest cost after the deposit? | For most buyers in Australia, stamp duty (or transfer duty) is by far the largest additional expense. It can be tens of thousands of dollars, depending on the property's value and your state. |

| Can I negotiate any of these extra costs? | Some, yes. You can shop around for more competitive conveyancing fees and building inspection services. However, government charges like stamp duty and registration fees are non-negotiable. |

| Do I need cash for all these costs, or can some be added to the loan? | Most upfront costs, like stamp duty and legal fees, must be paid in cash at settlement. LMI is one of the few major costs that can often be capitalised (added to your loan). |

Hopefully, these answers help you get a much clearer picture of what to expect.

Ready to give your clients a powerful, branded tool that answers all these questions and more? CalcWidgets offers a suite of professional mortgage calculators designed for Australian brokers. Embed our tools on your site to capture more leads and empower your clients. Explore our solutions at https://www.calcwidgets.com.

Article created using Outrank

Related Articles

Refinancing Mortgage Calculator Your Guide to Savings

Use our refinancing mortgage calculator to see your potential savings. Compare rates, understand costs, and make a smarter home loan decision in Australia.

How to Calculate Home Loan Interest: Your Australian Guide

Learn how to calculate home loan interest easily with our Australian guide. Discover simple steps to manage your mortgage effectively today!

5 Australian Property Investment Strategies for 2025

Discover the top 5 property investment strategies for 2025 in Australia, including regional markets, build-to-rent, and smart financing techniques.