Refinancing Mortgage Calculator Your Guide to Savings

Use our refinancing mortgage calculator to see your potential savings. Compare rates, understand costs, and make a smarter home loan decision in Australia.

So, what exactly is a mortgage refinancing calculator? In simple terms, it's a digital tool designed to show you the potential savings you could make by switching your home loan. It works by comparing your current mortgage against a new loan offer, calculating the new monthly repayments and estimating the total financial upside. This helps you figure out if making the switch is actually worth your while.

Your Financial GPS for Home Loan Refinancing

Think of a refinancing calculator as a kind of financial GPS for your home loan. But instead of showing you the fastest driving route, it maps out the smartest financial path for your mortgage. It’s all about helping you navigate the sometimes confusing world of refinancing with a bit more clarity.

For a lot of Aussie homeowners, even the thought of refinancing can feel a bit much. You're suddenly drowning in numbers, strange industry terms, and a flood of different offers from lenders. This is precisely where a good calculator becomes your best mate, cutting through the noise to answer your most important questions.

Turning Complexity Into Clarity

At its heart, a refinancing calculator takes a jumble of financial data and turns it into a simple, actionable snapshot of your potential future. It lines up all the variables that are tricky to compare on their own and presents them in a way that just makes sense.

This powerful little tool helps you get your head around:

- Interest Rate Differences: It shows you exactly how a tiny drop in your interest rate can add up to massive savings over the full life of your loan.

- Loan Term Impact: The calculator clearly demonstrates how changing your loan term—whether shortening or extending it—impacts both your monthly repayments and the total interest you'll pay over time.

- Upfront Costs vs. Long-Term Gains: It helps you weigh up the immediate costs of refinancing against the long-term monthly savings. This is a crucial calculation for making a smart decision.

Answering Your Biggest Questions

The main job of a refinancing calculator is to give you clear, data-driven answers to the questions keeping you up at night. It takes you from a place of pure guesswork to a position of genuine knowledge, so you can walk into a conversation with a lender or broker feeling confident.

A good calculator doesn’t just spit out a new monthly repayment figure. It shows you your break-even point—the exact moment when the savings you've accumulated officially outweigh the initial cost of refinancing. That's the real test of a successful switch.

By plugging in the details of your current loan alongside a potential new one, the calculator instantly tells you whether a move is genuinely going to benefit you. You’ll understand if you'll be better off in one year, five years, or right through to the end of the loan.

Ultimately, this tool puts you back in the driver's seat. For any homeowner in Australia thinking about a mortgage change, using a refinancing mortgage calculator is the essential first step. It transforms a daunting financial decision into a clear, manageable process and gives you the solid foundation you need for a smarter financial journey.

How the Refinancing Calculator Works

Think of a refinancing mortgage calculator as a financial GPS. It needs to know your starting point (your current loan) and your potential destination (the new loan) to map out the best route. Just like a GPS needs accurate addresses, the calculator needs precise financial data to give you a clear, reliable answer.

At its core, the calculator’s job is surprisingly simple. It takes all the details of your current loan, puts them side-by-side with a potential new loan, and then works out the real-world financial difference once you factor in all the switching costs. It's a powerful way to turn a bunch of confusing numbers into a straightforward "yes" or "no."

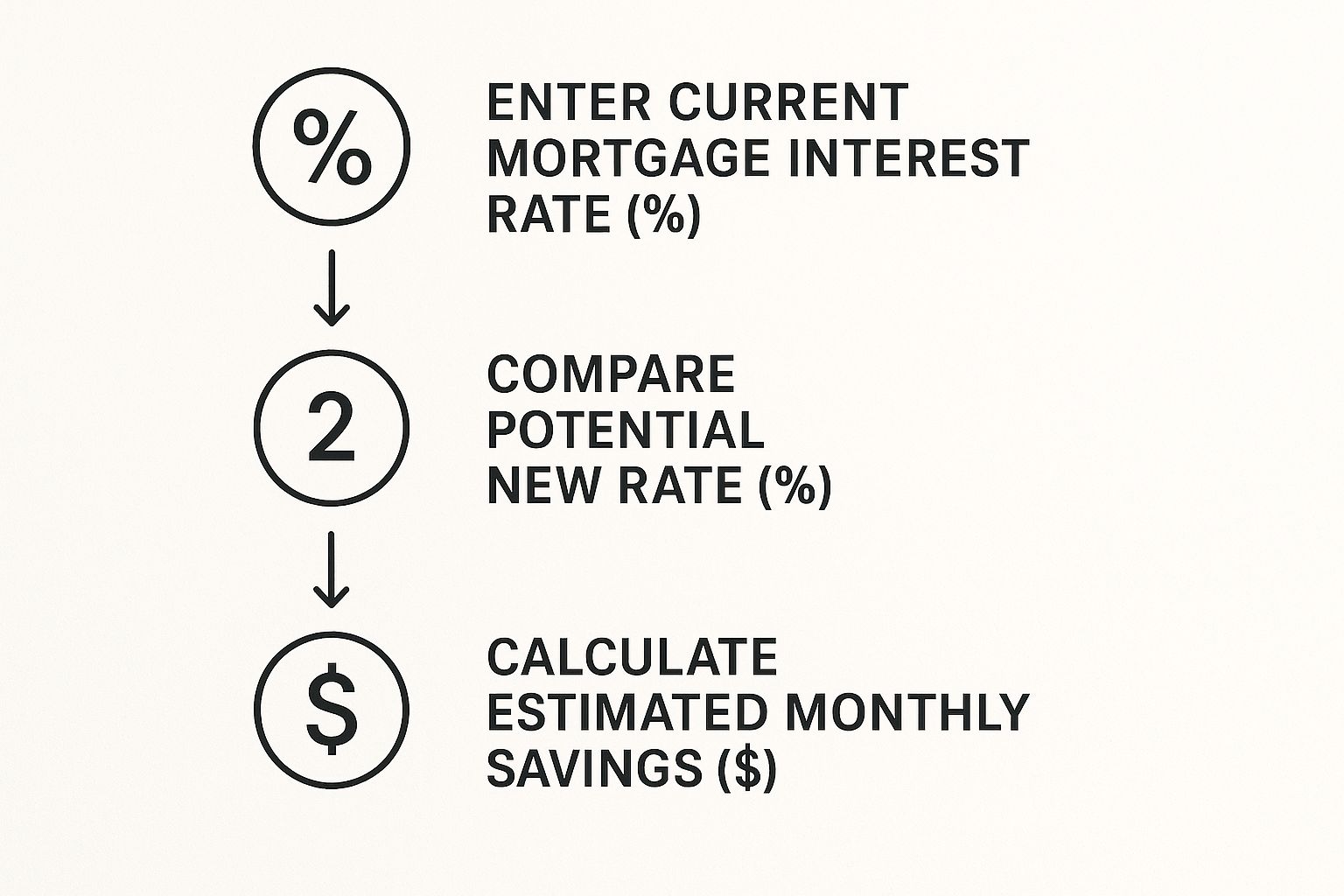

This process flow shows how a calculator takes the two interest rates to estimate your potential savings each month.

As you can see, the main function is to directly compare your old and new financial commitments, showing you the potential benefit in real dollar terms.

The Essential Inputs for Your Calculation

To get a truly useful result, you first need to gather a few key pieces of information. Garbage in, garbage out—the accuracy of the output depends entirely on the accuracy of what you put in.

Here's a closer look at the data points a good refinancing calculator needs to do its job properly.

<br>Essential Inputs for Your Refinance Calculation

| Data Input | What It Means | Why It's Important |

|---|---|---|

| Current Loan Balance | The exact amount you still owe on your mortgage. | This is the starting principal for the new loan and the basis for all interest calculations. |

| Current Interest Rate | The percentage you're paying on your existing loan. | This sets the baseline. The calculator needs it to figure out how much you're paying right now. |

| Remaining Loan Term | How many years and months are left on your current loan. | This determines the total interest you’re on track to pay if you stick with your current loan. |

| New Interest Rate | The advertised rate for the new loan you’re considering. | This is the headline figure. The calculator uses it to project your new repayment amount. |

| New Loan Term | The length of the new mortgage, often 25 or 30 years. | This defines the new repayment schedule and impacts the total interest paid over the life of the loan. |

These inputs build the foundation of the comparison, allowing the calculator to model your new repayment scenario against your old one and see if you’ll come out ahead.

Don’t Forget the Refinancing Costs

It's a classic mistake: getting dazzled by a lower interest rate while completely overlooking the upfront costs of making the switch. A quality calculator won't let you fall into that trap. It forces you to account for these expenses to give you a true picture of the net benefit.

The most critical output from a refinancing mortgage calculator isn't just the new monthly payment. It's the break-even point—the precise moment when your accumulated savings from the lower rate finally surpass the initial costs of making the switch.

To get to this magic number, you need to add in potential fees like:

- Exit Fees: What your current lender might charge for paying off the loan early.

- Application Fees: The cost charged by the new lender to process your paperwork.

- Valuation Fees: The price for having your property professionally valued.

- Government Charges: State-based fees for discharging the old mortgage and registering the new one.

By subtracting these costs from your projected savings, the calculator shows you exactly how long it will take for the refinance to actually start saving you money.

A Practical Example with Chloe

Let's walk through a real-world scenario with Chloe, a homeowner in Sydney. She has a current loan balance of $500,000 with an interest rate of 6.2% and 25 years left to go. Right now, her monthly repayment is about $3,288.

Chloe has found a new loan with a much better rate of 5.7% on a new 25-year term. She does her homework and estimates the total refinancing costs (exit fees, application fees, and government charges) will be around $2,500. She plugs all of this into a refinancing mortgage calculator.

The calculator immediately tells her the new monthly repayment would be $3,132, a saving of $156 per month.

But it doesn't stop there. It then performs the crucial break-even calculation: $2,500 (total costs) ÷ $156 (monthly savings) = 16 months. This tells Chloe she’ll have covered her costs and will start banking real savings after just 16 months.

For mortgage brokers, presenting this kind of clear, data-backed scenario is incredibly powerful. You can explore how to embed a refinance calculator on your website to offer this same value directly to your clients. Given the average refinancing loan in Australia stood at around AU$582,137 in mid-2025, even a small rate reduction can make a massive difference.

Translating Calculator Results Into Smart Decisions

Alright, so you’ve plugged your numbers into a refinance calculator and a bunch of figures have appeared on the screen. It’s tempting to just zero in on that one exciting number—the new, lower monthly repayment—but that’s only a tiny part of the story.

To make a truly smart decision, you need to look at the whole picture. Those numbers are more than just data; they’re telling you a story about your financial future. And understanding that story means looking at a few key metrics together.

These core outputs work in harmony to show you not just if you'll save money, but also how and when those savings will actually kick in.

Decoding Your Key Financial Outputs

A good refinance calculator won't just spit out a single answer. It gives you a dashboard of results, and when you look at them together, you get a much clearer idea of what switching your home loan really means in the long run.

Think of these as the three main dials you need to watch:

- Your New Monthly Repayment: This is the one you feel straight away. It’s the immediate impact on your monthly budget and is usually what gets people thinking about refinancing in the first place.

- Total Interest Savings: This is the long-term prize. It calculates how much interest you’ll avoid paying over the entire life of the new loan. We’re often talking tens of thousands of dollars here.

- The Break-Even Point: This is arguably the most important number of all. It tells you exactly when your savings have officially covered the upfront costs of making the switch.

Each of these pieces is crucial. A lower monthly repayment feels fantastic, but if it comes with a much longer loan term, you could end up paying way more interest over time. That's why you have to look at all three together—it’s non-negotiable.

The All-Important Break-Even Point

The break-even point is your financial tipping point. It’s the moment your refinance stops being an expense and starts putting real money back in your pocket. Calculating it is simple but incredibly powerful.

The formula is straightforward: Total Refinancing Costs ÷ Monthly Savings = Number of Months to Break Even. This little calculation is the ultimate test of whether refinancing actually fits your life and future plans.

For example, say the costs to refinance total $3,000 and you’ll be saving $200 a month. Your break-even point is 15 months ($3,000 ÷ $200). For the first 15 months, your savings are just paying off the cost of the switch. But from month 16 onwards, that $200 is pure, extra cash in your account.

This number is so vital because it grounds the decision in reality. If you think you might sell your home in two years, but your break-even point is three years away, refinancing would actually cost you money.

Applying the Results to Your Goals

The numbers from a refinancing mortgage calculator are only as good as how you apply them to your own goals. Are you trying to free up cash flow for day-to-day life, or is your main mission to kill that mortgage off as fast as possible? The results will point you in the right direction.

Let's look at two different scenarios:

- The Budget-Focused Family: They need more breathing room in their monthly budget to handle school fees, groceries, and life in general. For them, a lower monthly repayment is the number one priority, even if the loan term stays the same.

- The Aggressive Saver: This homeowner hates debt and wants to be mortgage-free ASAP. They might refinance to a shorter loan term, which could mean higher monthly repayments, but they’ll save a fortune in interest over the long haul.

By playing with the calculator's settings, you can model these different situations and see which loan structure actually helps you achieve what you want. It takes you from a vague idea of "saving money" to a clear, actionable plan. That's where the real power of these tools lies.

Identifying the Right Time to Refinance in Australia

<iframe width="100%" style="aspect-ratio: 16 / 9;" src="https://www.youtube.com/embed/Z4vz8aa_vxs" frameborder="0" allow="autoplay; encrypted-media" allowfullscreen></iframe>When it comes to refinancing, timing is everything. Just like a surfer waiting for that perfect wave, a homeowner has to spot the right conditions to really make it count. Getting the timing right can be the difference between a small saving and a huge financial win.

A refinancing mortgage calculator is your best tool for this. It helps you shift from being a passive borrower to an active manager of your own home loan. You can test out different scenarios as the market changes, turning abstract economic news into a real opportunity to save money. The trick is knowing what signals to watch for.

Think of these signals as your cue to pull out the calculator and start crunching the numbers. If you stay ready, you can act the moment the market gives you an opening.

Key Moments to Consider Refinancing

Certain life events and market shifts create clear windows of opportunity for refinancing. The first step to a smart financial move is simply learning to spot these moments and understand why they matter. Think of them as green lights, telling you it’s time to take a hard look at your current loan.

Here are the most common triggers for Aussie homeowners:

- Changes to the RBA Cash Rate: When the Reserve Bank of Australia (RBA) drops the official cash rate, lenders often follow with more competitive interest rates. This is a classic sign that it's time to see if you can lock in a better deal.

- Your Fixed-Rate Period is Ending: This one is a biggie. As your fixed term wraps up, your loan usually defaults to a much higher standard variable rate. This is a critical moment to shop around to avoid a sudden and painful jump in your monthly repayments.

- A Significant Jump in Your Home's Value: Has your property value shot up recently? That’s fantastic, because it boosts your equity. A higher equity position lowers your loan-to-value ratio (LVR), which often makes you eligible for much sharper interest rates.

- Your Financial Situation Has Improved: If you’ve had a pay rise or your credit score has improved since you first took out the loan, you’re now a more attractive borrower. Lenders will likely offer you better terms than you originally qualified for.

By running the numbers through a refinancing calculator during these periods, you can see exactly what the potential benefits are in real-time. It takes the vague idea of "getting a better deal" and turns it into a solid plan with a clear savings target.

Keeping up with these market movements is key. To get a better handle on the forces at play, check out our guide on understanding Australian mortgage rates.

Connecting Market Trends to Your Mortgage

Economic news isn't just for the experts on TV; it has a direct impact on your household budget. For example, any talk from the RBA about inflation can signal future rate changes, giving you a valuable heads-up on when to start exploring your refinancing options.

Just look at recent market activity. In the first quarter of 2025, refinancing in Australia surged, which pointed to a major shift in the home loan market after the RBA made changes to the cash rate. The Australian Bureau of Statistics (ABS) reported that a total of 65,030 home loans were refinanced between lenders in the March quarter alone. That's a 5.1% increase from the previous quarter.

This data proves that thousands of Australians are actively using market shifts to their advantage. A refinancing calculator is the essential tool that connects a headline about the RBA to real, tangible savings on your monthly mortgage repayment. It lets you run the numbers for your specific loan, making sure you don't miss out when a window of opportunity opens up.

Common Refinancing Mistakes to Avoid

A fantastic new interest rate can feel like a massive win, but that shiny new number can sometimes distract from some very costly mistakes. Refinancing isn't just about chasing a lower rate; it's a strategic move to improve your overall financial position. Unfortunately, a few common traps can quickly turn those potential savings into a long-term financial headache.

This is where your refinancing mortgage calculator steps up. It’s not just a tool for estimating savings; it’s your essential safety check. By running the numbers properly, you can spot these red flags before they do any damage, making the calculator one of your best risk-management tools.

Think of it as your financial co-pilot, double-checking the flight plan before you commit. It helps ensure your new loan is actually flying you towards your goals, not somewhere else entirely.

Ignoring the Upfront Fees

One of the most common blunders is getting fixated on the lower interest rate while completely overlooking the fees needed to secure it. Discharge fees from your old lender, application fees for the new one, and various government charges can easily add up to thousands of dollars.

Lower monthly repayments are appealing, but if it takes you five years just to claw back the cost of refinancing, you really have to question whether it’s worth it. This is exactly what the break-even point calculation is for.

A low rate is the bait, but the total cost is the reality. The calculator forces you to weigh the immediate cost against the long-term gain, ensuring you make a decision based on the full picture, not just the attractive headline rate.

By punching in all the associated costs, the calculator shows you precisely how long it will take for your monthly savings to cover the initial outlay. If that timeline doesn’t match how long you plan to own the property, refinancing could actually leave you out of pocket.

Accidentally Extending Your Loan Term

Here’s a sneaky one that catches a lot of people out: refinancing a loan with 22 years left back to a fresh 30-year term. On paper, it looks great because your monthly repayments will almost certainly drop, creating a false sense of saving. The catch? You’ve just signed up for an extra eight years of interest payments.

While this might offer some welcome relief to your monthly cash flow, the total interest you pay over the life of the loan can skyrocket. It's a classic case of winning the battle but losing the war.

Your calculator helps you model different scenarios to steer clear of this trap:

- Match the Remaining Term: See what your repayments would look like if you refinanced to a new 22-year term.

- Shorten the Term: Could you comfortably manage a 20-year term and pay the loan off even faster?

- Compare Total Interest: A quality calculator will show you the total interest paid for each option, making the long-term cost painfully clear.

Running these comparisons is absolutely vital. A comprehensive refinancing guide for 2025 can provide more in-depth strategies, but using the calculator to compare the total interest is your first and best line of defence.

Overlooking Lenders Mortgage Insurance

Lenders Mortgage Insurance (LMI) is a hefty cost for anyone with less than 20% equity in their property. You might have dodged it when you first bought your home, but if the property value has dipped or you started with a small deposit, you could find yourself below this threshold when you try to refinance.

If your loan-to-value ratio (LVR) is over 80%, you could be slugged with a new LMI premium on your new loan. This one-off cost can run into thousands of dollars, potentially wiping out any savings from the lower interest rate for years to come.

Before you get too far down the refinancing path, use your property’s current estimated value and your outstanding loan balance to calculate your LVR. If it’s hovering around or above that 80% mark, proceed with caution and be sure to factor potential LMI costs into your calculator.

Using Your Calculator in a Competitive Market

The Australian mortgage market is moving faster than ever. For anyone looking to refinance, it can feel like you're being flooded with offers, each one screaming that it's the best deal out there. In this kind of environment, a refinancing mortgage calculator isn't just a handy gadget—it's your secret weapon.

Lenders are pulling out all the stops with slick tech to speed up their application process and win you over. This creates a lot of noise, and it’s easy to get lost in the marketing hype instead of focusing on what really delivers long-term value. A calculator cuts straight through the distractions by boiling everything down to what truly matters: the numbers. It gives you a clear, unbiased comparison, turning a bewildering decision into simple maths.

This is about more than just shaving a few points off your interest rate. It's about stepping into the process as an informed, prepared borrower who can make a move with total confidence.

Staying Ahead in a Tech-Driven Market

The sheer speed of today's market is changing the game for lenders. It’s not just about who has the lowest rate anymore. As market experts point out, the lenders who can process huge volumes of refinancing applications quickly and accurately are the ones who will come out on top. You can get a deeper look into how AI is shaping the future of mortgage refinancing from FICO's analysis.

What does this mean for you? It means you need to be just as ready to act. When you have your figures sorted, you can evaluate new offers the moment they appear.

By running the numbers through a calculator before you even pick up the phone to a lender, you're arming yourself with critical knowledge. You'll know exactly what a "good deal" actually looks like for you, which stops you from getting dazzled by an offer that doesn’t really fit your long-term goals.

This kind of preparation puts you firmly in the driver's seat, letting you negotiate from a position of strength, not hope.

From Reactive Borrower to Proactive Planner

Ultimately, a refinancing calculator changes how you approach your mortgage. Instead of just reacting to whatever offers land in your inbox, you can start actively hunting for opportunities that genuinely line up with your financial plan.

Think about using it for some forward-planning:

- Scenario Planning: What if rates go up? Or down? You can model different scenarios to see how future market shifts might affect your savings.

- Goal Alignment: Play around with different loan terms. See how a shorter term could help you own your home sooner, or how a longer one might free up some much-needed cash each month.

- Equity Checks: As your property value increases, you might qualify for much better rates. Periodically check your numbers to see when it might be the right time to renegotiate.

When you start using a refinancing calculator regularly, it stops being a one-off tool and becomes a trusted partner in managing your finances. You get the insights you need to navigate a complex market—not just for today, but for the entire life of your loan. It’s about making savvy choices that build real, lasting wealth.

Frequently Asked Questions

Even with the best tools on your side, it’s only natural to have questions when you’re dealing with something as significant as a home loan. We’ve put together some quick, clear answers to the most common queries we hear about using a refinancing calculator.

Think of this as a quick-start guide to help you get the most out of the numbers and feel confident in your next steps.

How Accurate Is a Refinancing Mortgage Calculator?

A refinancing calculator is incredibly accurate, but its precision is a direct reflection of the information you put in. To get a truly reliable result, you need to input the exact figures: your current loan balance, the precise interest rate from your latest statement, and any potential fees tied to both your old and new loans.

It works like any perfect mathematical tool – the output is only ever as good as the input. While it gives you a brilliant estimate for comparing loans, the final, official figures will always come from the lender's loan offer documents.

A calculator gives you a clear and reliable financial forecast based on your data. It’s an essential first step for an estimate, but the lender's formal offer is always the final word.

Can I Use a Calculator If I Want to Access Equity?

Absolutely, though you might need a more advanced calculator or have to make a simple manual adjustment. Most standard refinancing calculators are set up to compare one loan directly against another of the same value.

If you’re planning a 'cash-out' refinance to access your home's equity, your new loan balance will be higher than your current one. Some of the better calculators have a specific field for a 'cash-out amount'. If yours doesn't, you can simply add the cash-out sum you want to your current loan balance and pop that total into the 'new loan amount' field. Just keep in mind this will naturally increase your repayments, as the calculation will be based on a larger principal.

How Often Should I Check for Refinancing Opportunities?

It's a smart habit to give your mortgage a quick 'health check' with a refinancing calculator at least once a year. This is a simple way to stay on top of where you stand in the market.

Beyond that, you should definitely run the numbers whenever certain financial triggers pop up. These include:

- When your fixed-rate period is coming to an end.

- After the RBA makes a significant change to the official cash rate.

- If your personal financial situation gets a boost, like a pay rise.

- When you start seeing lenders advertising rates that are obviously much lower than what you're paying.

Regular checks ensure you never miss a chance to save a serious amount of money.

Ready to give your clients the best tools for the job? CalcWidgets offers professional, embeddable mortgage calculators designed specifically for Australian brokers. It's a simple way to add value to your website and generate more leads.

Learn more about our custom calculator widgets

Article created using Outrank

Related Articles

Aussie House Purchase Costs Calculator Guide

Our house purchase costs calculator guide breaks down every hidden fee. Budget for stamp duty, LMI, and legal costs in Australia with confidence.

How to Calculate Home Loan Interest: Your Australian Guide

Learn how to calculate home loan interest easily with our Australian guide. Discover simple steps to manage your mortgage effectively today!

5 Australian Property Investment Strategies for 2025

Discover the top 5 property investment strategies for 2025 in Australia, including regional markets, build-to-rent, and smart financing techniques.